Know Your Worth: What Makes A Coin Valuable?

- Sep 20, 2025

- Learn

- 4 minutes read

What makes a coin valuable? According to Mr. Benoit Doyon, founder of Quebec-based Imaginaire boutiques, this is one of the most frequently asked questions on the secondary market. The short answer is, if someone wants a coin, then that coin has a re-sale value.

Though a collector may love to see their newest purchase instantly double in value, determining a coin’s future worth isn’t an exact science. However, Doyon explains that there are a few factors that can help gauge whether some coins in your collection could see an increase in value with time.

What makes a coin valuable? According to Mr. Benoit Doyon, founder of Quebec-based Imaginaire boutiques, this is one of the most frequently asked questions on the secondary market. The short answer is, if someone wants a coin, then that coin has a re-sale value.

Though a collector may love to see their newest purchase instantly double in value, determining a coin’s future worth isn’t an exact science. However, Doyon explains that there are a few factors that can help gauge whether some coins in your collection could see an increase in value with time.

Supply

As a general rule, a hard-to-find coin will fetch a higher price than one that’s more common. That’s why some collectors pay attention to each coin’s mintage, or maximum number of coins that can be produced.

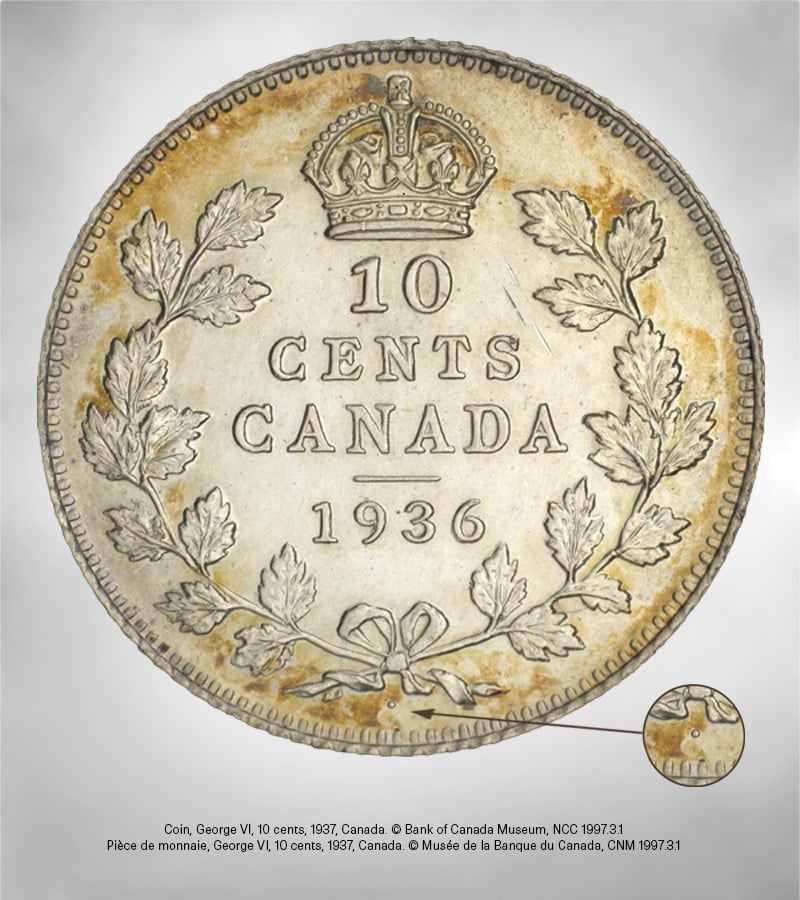

But mintage isn’t the only consideration—you also need to take into account how many of those coins are actually available in order to determine true rarity, especially with older coins. Take, for example, the famous '1936 Dot Dime'. A total of 191,237 'dotted dimes' were struck in 1937 but most were melted down. Today, out of the six "1936 Dot Dimes" that have ever been found, only three exist outside of museum collections. That extreme rarity is key to understanding why a coin with a 10-cent face value and bearing a tiny dot is worth upwards of $144,000.

… and Demand

Demand is the single biggest factor that can drive up a coin’s value, and it can have a significant impact on even the rarest coins.

Say 1,000 collectors are looking for a specific coin, but there are only five known in existence: the price for those coins will continue to rise as collectors vie for them on the secondary market. On the other hand, if there are 1,000 coins but only five people are interested, that limited demand means the coin may not see much of a bump in value.

Dealers anticipate the market’s interest and stock accordingly, but they also know that tastes and interests change over time. Ultimately, the collector is key to driving demand and determining a coin’s value.

In addition to the law of supply and demand, other factors may also contribute to the value of a coin on the secondary market.

Age

An old coin must be worth more, right? Surprisingly, age doesn’t guarantee a higher value. Ancient coins can be purchased for less than modern ones.

Some collectors tend to place more importance on things we associate with age; for example, older coins are generally harder to find, and when you do find them, they’re not always in pristine or “mint” condition.

Nonetheless, time is your ally. If the value has already increased once, there’s likely to be a demand for it in the future. There may be renewed interest in a coin in 10 or 20 years from now, especially if its theme or design is back in the spotlight.

Condition

The better the condition, the higher the value. A coin’s condition (grade) indicates how much wear has occurred and if it shows any physical damages (scratches, dents, corrosion, etc) or changes in colour or tone.

Those in "mint" condition tend to have a higher value than those with even the slightest flaw. However, as the years go by, it gets harder to find perfectly preserved pieces, and that’s where supply and demand come in to drive up the value.

Eye Appeal

Coins are pieces of collectible art, and like a painting or sculpture, some collectors place a higher value on collectibles with eye-catching or unique designs or technology, like some of our special shaped offerings.

Obviously, buyers want the best specimen—one with plenty of eye appeal and a sharp, crisply struck design. If a coin looks good to you, chances are it will probably appeal to others too.

Metal Composition

Investment-minded collectors will seek out coins that command higher prices and net them a profit when re-selling. Since gold, silver and platinum bullion are worth a lot on the commodities market, coins crafted from these precious metals are often viewed as having an investment value that is based on what the metal is worth (“intrinsic value”).

But don’t turn your back on coins made with less-expensive metals! For example, tombac (a brass alloy) nickels are popular among collectors because they represent a special variation, and that makes them worth a lot more than five cents.

In summary

A few other considerations can bump up a coin’s value, such as rare variations and subtleties (like the “No LCW” variety of the 1870 50-cent coin), historical significance, or even (gasp!) errors.

But there’s something to be said about a coin’s value in the eyes of its owner. The true gems are the collectibles that speak to you personally, whether it’s the gift set that marked a special occasion, the oval-shaped coin that speaks to your love of dinosaurs, or a theme that’s dear to your heart. Collecting should be fun, wherever your interests lie, so let that guide you on your collecting journey.

Originally published May 19, 2021, updated September 20, 2025.

This article was prepared with input from Mr. Benoit Doyon, founder of Quebec-based Imaginaire boutiques. Mr. Doyon has been in the business of buying/selling coins and stamps since 1986. Today, Imaginaire’s five locations employ more than 70 passionate experts and offer a wide variety of collectibles—coins, bank notes, stamps, comic books, figurines, trading cards, and more.

Facebook (FR/EN): BoutiqueImaginaire

Instagram (FR): imaginaire.86